Why and how to research purchase behaviour

Purchase behaviour research explains why customers choose a specific brand and channel, where decisions shift, and what blocks conversion. At NMS, we build a custom design and combine quantitative and qualitative methods so the outputs aren’t just “data”, but practical recommendations and reporting you can use.

Quick summary:

- purchase drivers and barriers

- decision moments across channels

- differences between customer segments

- inputs for offer, communication, and CX

- option to segment customer profiles

- combination of online research + deep-dive methods

- analysis + recommendations (not just tables)

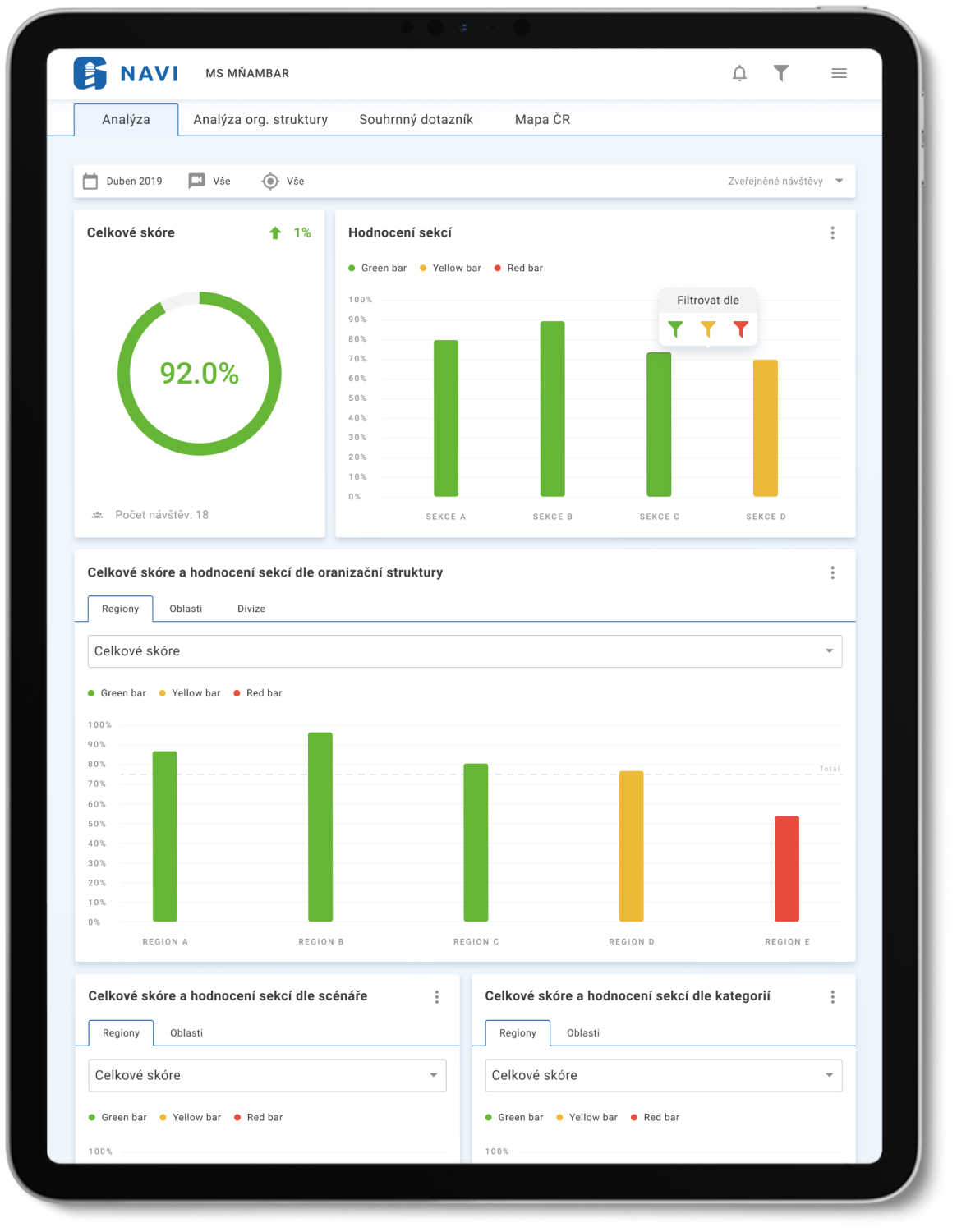

- interactive reporting in an online app

- links to core CX topics (journey, satisfaction, CX management)

What purchase behaviour research gives you

- A clear “why” behind customer behaviour — what triggers purchase and what stops it.

- Better offer and messaging — based on how people really choose (not assumptions); if you also need to connect this to post-purchase care, it makes sense to add customer satisfaction measurement.

- Segments you can act on — different customer types, different motivations, different value arguments.

- A map of decision moments — where it pays off to invest (channel, touchpoint, message, promo); in a broader context this often complements customer journey mapping.

- Stronger foundations for CX and performance — because when you understand purchase decisions, it’s easier to improve what happens after the purchase too.

What we solve — and when this makes sense

We use purchase behaviour research when you need to understand why people choose a certain brand, why they switch channels (online vs. store), and where the decision is made. It’s a strong fit when you’re changing portfolio, pricing, or communication — or when conversion drops and you don’t want to decide “blind”. We often place the findings directly into the broader framework of the customer journey or connect them to CX management so insights quickly translate into real changes.

This service makes sense anywhere customers compare alternatives and decide based on a mix of price, availability, trust, and experience. Typical owners are marketing/brand, e-commerce, sales/category management, and CX/CRM; if you need to validate the in-store reality, this pairs well with

mystery shopping. And if you find that different groups buy for different reasons, the natural next step is customer segmentation.

How we approach purchase behaviour research at NMS

We don’t sell a template. First, we align on the decision you need to make (communication, offer, channel, CX) — then we design the research around it. We typically combine:

- Online research (quant) — to quickly collect robust data and test hypotheses at scale.

- Qualitative deep dive — when you need motivations, customer language, and context (interviews, focus groups, or an online community) — for example via an online insight community.

- Customer segmentation — to split audiences into clear groups by behaviour and motivations, and show where the biggest potential sits.

What you get (and why it works)

You’ll receive a clear analysis and recommendations on what to change in the offer, communication, or channels — including a short executive summary. If the goal is to work with different customer types, we’ll also prepare practical profiles (building on customer segmentation). We can also deliver outputs as online reporting so teams can use them across the organisation.

We design research around the goal — usually combining robust data (e.g., online research) with deep understanding of motivations (e.g., online insight community).

We work to professional standards — we’re members of ESOMAR, SIMAR, SAVA, and MSPA — and our client work backs it up.

Questions & answers

What is purchase behaviour research?

Research that shows how people choose, where they decide, and what influences purchase (both drivers and barriers) across channels.

When does it pay off the most?

When you’re dealing with a conversion drop, a change in offer/communication, a channel shift, or when you need to identify growth segments.

Which methods do you use?

We choose methods based on the decision — typically combining online survey research, customer segmentation and qualitative methods: online insight community, qualitative research (interviews & focus groups).

Will I get actionable recommendations, or just data?

Action is part of the output: analysis plus recommendations for improvement. We can also add interactive reporting in an online app.

Can you capture differences between customer types?

Yes — if segmentation is the goal, we identify customer profiles and show where the best potential to win is.

Is this only for retail/FMCG, or also for services?

It works anywhere customers have alternatives and actively choose — retail, e-commerce, and services.

How do I know it’s done professionally?

NMS is a member of ESOMAR and SIMAR (and other professional organisations). We work to high standards.

Can this be combined with other CX research?

Often yes — for example with customer journey mapping or customer satisfaction measurement.